Tracking Spending: Small Habits That Make a Big Difference

Tracking Spending: Small Habits That Make a Big Difference

In a world of one-click purchases, cashless transactions, and subscription services, it’s easier than ever to lose track of where your money is going. While earning more is often seen as the path to financial freedom, what you do with the money you already have plays an equally important role. This is where the habit of tracking your spending becomes a game-changer.

Tracking your expenses may sound tedious, but it is one of the most impactful habits you can cultivate for financial health. It lays the foundation for budgeting, helps identify wasteful spending, and empowers you to make smarter decisions with your money. In today’s context—marked by economic uncertainty, inflation, and evolving spending behaviors—monitoring your spending is more relevant than ever.

Why Tracking Spending Matters

Most people are surprised when they start tracking their spending. Little purchases that seem insignificant—a daily coffee, spontaneous online orders, or food delivery fees—can add up to hundreds, if not thousands, of dollars over the course of a year.

Here’s why keeping tabs on your spending matters:

- Awareness: You can’t manage what you don’t measure.

- Control: Knowing where your money goes helps you redirect it toward what truly matters.

- Debt Reduction: Helps identify areas to cut back and apply the savings to debt repayment.

- Goal Achievement: Frees up resources for savings, travel, investments, or large purchases.

Key Concepts and Considerations

Before diving into the mechanics of tracking, it’s useful to understand the types of expenses and behaviors that influence spending:

- Fixed vs. Variable Expenses:

- Fixed: Rent, insurance, subscriptions

- Variable: Groceries, dining out, utilities

- Discretionary vs. Non-discretionary Spending:

- Discretionary: Entertainment, hobbies, fashion

- Non-discretionary: Bills, transportation, healthcare

- Emotional Spending:

- Purchases made out of boredom, stress, or habit

- Often unconscious but impactful on financial well-being

Understanding these categories helps you spot trends and make meaningful changes.

How to Start Tracking Your Spending

Step 1: Choose Your Tracking Method

Pick a system that works for your lifestyle and preferences:

- Apps: Mint, PocketGuard, YNAB, or EveryDollar automatically sync with bank accounts.

- Spreadsheets: Excel or Google Sheets offer customizable tracking.

- Manual Journaling: Write down each expense in a notebook—great for mindfulness.

Tip: The best method is the one you’ll actually use consistently.

Step 2: Record Every Expense

Track every dollar you spend, no matter how small. This includes:

- Bills

- Daily coffee runs

- Snacks and vending machine purchases

- Streaming services

- ATM withdrawals and cash transactions

Example: David thought he spent $30 a month on takeout, but after tracking, he realized it was closer to $150. This insight helped him set a reasonable limit and redirect funds to his savings account.

Step 3: Categorize Your Spending

Break your expenses into categories to identify patterns:

- Housing

- Transportation

- Food and dining

- Entertainment

- Health and wellness

- Subscriptions and memberships

Over time, this reveals where you might be overspending or underestimating your costs.

Step 4: Review Weekly or Monthly

Set a recurring time to review your expenses. Look at:

- Total spending vs. income

- Categories with unexpected high spending

- Opportunities to cut back or optimize

This step is where the learning and growth happen.

Practical Tips for Building the Habit

- Start Small: Begin by tracking just one category (like food or entertainment) for a week.

- Use Alerts: Set bank or app alerts for spending thresholds.

- Gamify It: Turn spending less into a challenge or reward system.

- Be Honest: Don’t skip tracking because it’s uncomfortable. Awareness is key.

- Stay Consistent: Like any habit, consistency yields the best results.

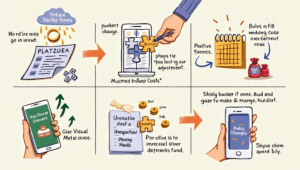

Real-Life Scenarios and Anecdotes

Emily’s Coffee Habit: Emily, a teacher, used to stop at a cafe every morning, spending around $6 per day. After tracking her spending for one month, she realized this added up to $180 monthly. She opted to make coffee at home and reserved cafe visits for Fridays only, cutting her coffee expenses to $30 and saving $150.

Tom’s Subscription Overload: Tom subscribed to multiple streaming platforms, news apps, and a fitness program. Tracking spending made him realize he rarely used half of them. He canceled unused subscriptions and saved $70 a month, which he redirected to his travel fund.

Asha’s Budget Breakthrough: Asha, a single mom, felt constantly strapped for cash. After tracking her spending, she noticed regular overdraft fees and impulse grocery buys. She started meal planning, shopping with a list, and setting alerts for her bank balance. Within three months, she had built a $500 emergency fund.

Tools and Resources

- Budgeting Apps: YNAB, Mint, EveryDollar

- Expense Trackers: Goodbudget, PocketGuard

- Spreadsheets: Use free templates available online

- Banking Tools: Many banks categorize spending in their apps

Final Thoughts: Small Habits, Big Impact

Tracking your spending might feel like a chore at first, but it quickly becomes second nature—and the rewards are immense. It’s not about depriving yourself; it’s about gaining awareness and making empowered choices with your money.

Financial transformation doesn’t require a sudden windfall or drastic lifestyle change. It starts with small, consistent habits like tracking where every dollar goes. Once you know your patterns, you can shape your financial future with confidence and clarity.

Take action today. Choose a tracking method, record your expenses for a week, and see what you learn. You might be surprised by the hidden opportunities in your own financial story.