Adjusting Your Budget for Life Changes and Unexpected Costs

Adjusting Your Budget for Life Changes and Unexpected Costs

In the dynamic landscape of modern life, change is the only constant. Whether it’s a career shift, a medical emergency, a new addition to the family, or even a global event like a pandemic, life changes can have a significant impact on your finances. While budgeting is a vital tool for achieving financial stability, the real power lies in a flexible budget—one that adapts as your life evolves.

Learning how to adjust your budget in response to life changes and unexpected costs is a critical skill for maintaining control over your money. It can prevent stress, reduce debt, and help you stay on track with your financial goals, even when life throws you a curveball.

Why Budget Adjustments Matter

Many people treat budgets as static, set-it-and-forget-it tools. But the most effective budgets are living documents. A job loss, a pay raise, a new baby, or even a broken water heater can shift your financial landscape. Failing to adapt your budget accordingly can lead to overspending, debt accumulation, or missed opportunities to save and invest.

Key Life Changes That Impact Budgets

- Career Changes

- Promotion or Pay Raise: Increases in income provide an opportunity to boost savings or pay off debt faster.

- Job Loss or Pay Cut: Requires immediate adjustments to reduce expenses and preserve emergency funds.

- Family Events

- Marriage or Divorce: Changes in household income and shared expenses require a reevaluation of priorities.

- New Child: Increases spending on childcare, healthcare, and daily essentials.

- Health Issues

- Medical emergencies can lead to high out-of-pocket costs and time off work, affecting both expenses and income.

- Relocation

- Moving to a new city or state can alter costs for housing, transportation, and living expenses.

- Unexpected Expenses

- Car repairs, home maintenance, or sudden travel needs can strain a tight budget.

How to Adjust Your Budget Effectively

1. Reassess Your Income

Start by calculating your new monthly income. If your income has increased, determine how much can be allocated to savings, investments, or debt repayment. If it has decreased, identify fixed and variable expenses to adjust accordingly.

Example: After switching from a full-time job to freelance work, Jenna found her income fluctuated each month. She created a bare-bones budget based on her lowest expected income and treated anything above that as a bonus for savings or extras.

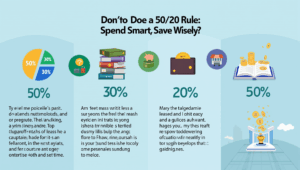

2. Reprioritize Your Expenses

Go through your current spending and identify areas to cut or scale back. Categorize your expenses into needs, wants, and goals.

- Needs: Essential expenses like housing, food, transportation

- Wants: Dining out, entertainment, subscriptions

- Goals: Savings, debt repayment, investing

3. Build or Replenish an Emergency Fund

An emergency fund acts as a financial cushion for unpredictable events. If you’ve dipped into yours, make it a priority to rebuild. Ideally, save 3–6 months’ worth of essential expenses.

Tip: Automate a portion of your income to go into your emergency fund each month.

4. Use Budgeting Tools and Apps

Digital tools can simplify tracking and modifying budgets. Apps like YNAB, Mint, and EveryDollar allow for real-time updates and adjustments based on your income and spending habits.

5. Communicate with Stakeholders

If you share finances with a partner, roommate, or family member, open communication is key. Ensure everyone understands the budget changes and agrees on the path forward.

Anecdote: When Mark and Lisa had their first child, they sat down to revisit their joint budget. They adjusted their grocery and entertainment spending, and reallocated more funds to childcare and savings for their child’s future.

6. Reevaluate Subscriptions and Recurring Costs

Small, recurring charges can drain your finances, especially when your income decreases. Evaluate whether each subscription or service is still necessary.

7. Look for Additional Income Sources

If your financial situation becomes strained, consider side gigs, freelancing, selling unused items, or tutoring. Even a small additional income can provide breathing room.

Real-World Example: After a company downsizing reduced her work hours, Tina started offering virtual tutoring sessions on weekends. This helped her cover rent and avoid dipping into savings.

8. Plan for Future Changes

Life changes are inevitable, so build flexibility into your budget. Include categories for irregular expenses (e.g., holidays, annual subscriptions, car registration) and increase contributions to a rainy day fund.

Signs You Need to Adjust Your Budget

- You’re frequently overdrafting your bank account

- You’re unable to contribute to savings

- Your debt is increasing

- You feel anxious about finances

- You’ve experienced a recent life change

If any of these apply, it’s time to sit down and rework your budget.

Tips for Staying on Track

- Review your budget monthly to catch new trends or changes.

- Stay realistic with spending limits—don’t aim for perfection.

- Use visual trackers to stay motivated and celebrate milestones.

- Build in buffer zones in your budget for unexpected small expenses.

Benefits of Budget Flexibility

- Reduces financial stress

- Builds resilience during tough times

- Keeps financial goals on track

- Encourages proactive rather than reactive money management

Final Thoughts: Embrace the Power of Flexibility

Life isn’t static, and your budget shouldn’t be either. Adjusting your budget in response to life changes and unexpected costs isn’t a sign of failure—it’s a hallmark of financial maturity. A flexible budget empowers you to respond to change with confidence rather than panic.

The key is to remain proactive. Anticipate, adjust, and communicate. Keep your financial goals in sight, even if the path to them shifts over time.

Take action today: review your current budget, assess any recent or upcoming changes, and make the necessary adjustments. Your financial health will thank you—and you’ll be better prepared for whatever comes next.