Mindful Money Management: Aligning Spending with Your Values

Mindful Money Management: Aligning Spending with Your Values

In a world driven by consumerism and instant gratification, mindful money management offers a refreshing and empowering alternative. It’s not just about budgeting or tracking expenses—it’s about consciously aligning your spending habits with your core values, priorities, and long-term goals. In today’s fast-paced financial environment, where lifestyle inflation and social media-fueled comparisons can easily derail your financial journey, being intentional with money is more important than ever.

This article dives into the concept of mindful money management, why it matters, and how to practice it effectively in your own life. You’ll discover practical strategies, real-life examples, and actionable tips to start making choices that reflect who you are and what truly matters to you.

What is Mindful Money Management?

Mindful money management is the practice of making financial decisions with awareness, clarity, and intention. Instead of reacting impulsively or following societal norms, mindful spenders ask themselves:

- Does this purchase align with my values?

- Will this contribute to my long-term happiness or financial well-being?

- Am I spending out of habit, emotion, or pressure?

It’s about moving from unconscious spending to deliberate choices, creating a life where your financial resources support your true priorities.

Why It Matters in Today’s Context

Our financial behaviors are heavily influenced by cultural messaging, marketing tactics, and emotional triggers. The rise of “buy now, pay later” schemes, influencer marketing, and targeted ads can lead to overspending and financial stress.

At the same time, many people are seeking more meaning, balance, and sustainability in their lives. The pandemic shifted perspectives, with more individuals prioritizing mental health, relationships, and purposeful living over material consumption.

Mindful money management helps bridge the gap between these desires and financial habits. It allows you to:

- Reduce financial stress and guilt

- Make progress on meaningful goals

- Increase satisfaction and joy in spending

- Build financial resilience

Key Concepts and Considerations

1. Know Your Values

You can’t align spending with your values if you’re not clear on what they are. Take time to reflect on what matters most to you. Is it family, freedom, creativity, health, community, or adventure? Rank your top 5 values and revisit them regularly.

Example: If health is a core value, you might prioritize spending on organic food, a gym membership, or wellness retreats, and cut back on fast food or late-night online shopping.

2. Track Your Spending with Intention

Tracking your expenses isn’t just a budgeting exercise—it’s a mindfulness tool. Review your transactions and ask, “Was this purchase worth it? Did it bring me closer to my goals or values?”

Apps like YNAB, PocketSmith, or even a simple spreadsheet can help. Look for patterns that don’t serve you—like spending out of boredom or buying to impress others.

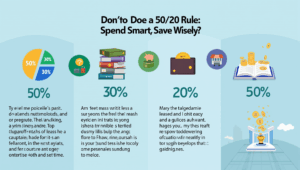

3. Create a Values-Based Budget

Traditional budgets categorize spending into necessities, wants, and savings. A values-based budget allocates money based on what truly matters.

Example: Instead of cutting “entertainment,” consider whether those expenses bring joy or align with your goals. You might keep your subscription to a favorite learning platform but cancel random streaming services.

4. Practice Conscious Spending

Before making a purchase, pause and reflect. Ask yourself:

- Is this a need or a want?

- Will I still value this a month from now?

- Am I buying this to feel better emotionally?

Even a 24-hour delay can reduce impulse purchases and increase satisfaction with what you do choose to buy.

5. Avoid Comparison Traps

Social media can distort our perception of normal spending. Remember, you’re seeing curated highlights, not financial realities. Practice gratitude for what you have and focus on your unique path.

Anecdote: Lisa, a teacher from Colorado, stopped scrolling Instagram shopping ads for a month and found her weekly spending dropped by 30%. She redirected the money toward a trip she’d been putting off for years.

Practical Steps to Get Started

- Define Your Financial Purpose What do you want your money to do for you? Financial freedom? Security? Adventure? Use this as your north star.

- Audit Your Current Spending Review the last 2-3 months of expenses. Highlight any purchases that don’t align with your values. This awareness is the first step to change.

- Automate Essential Savings Pay yourself first by setting up automatic transfers to savings or investment accounts. When saving becomes non-negotiable, your spending naturally adjusts.

- Declutter Financial Clutter Cancel unused subscriptions, consolidate accounts, and simplify where possible. A cleaner financial landscape makes mindful management easier.

- Set Monthly Intentions At the start of each month, choose one financial goal or theme—like “buy less, experience more” or “support local businesses.” This keeps you grounded and motivated.

- Use a Journaling Practice Reflect weekly or monthly on your spending. What felt good? What didn’t? What lessons did you learn? Journaling builds self-awareness over time.

Real-World Scenarios

Scenario 1: The Career Changer After 10 years in corporate, Alex wanted more freedom and purpose. He downsized his apartment, sold his car, and created a minimalist budget to fund his transition into freelance consulting. By spending mindfully, he made a major life change without taking on debt.

Scenario 2: The Young Family Sarah and Jake, new parents, reassessed their finances to prioritize time with their baby. They cut back on dining out and impulse buys, redirected funds into a college savings account, and started weekly “money dates” to stay aligned.

Scenario 3: The Recovering Impulse Spender Brian struggled with emotional spending after work. He started journaling, unsubscribed from email promotions, and set a 48-hour rule before purchases. Over six months, he saved over $2,000 and felt more in control.

Final Thoughts

Mindful money management is a journey, not a destination. It’s about progress, not perfection. By aligning your financial choices with your values, you can cultivate a more fulfilling, less stressful relationship with money.

The next time you open your wallet or your banking app, pause and ask: “Does this reflect the life I want to create?” When you spend with intention, every dollar becomes a tool for living a life you love.

Start small. Reflect often. And remember—your values are your greatest financial asset.

Take the first step today: review one area of your spending, connect it to your values, and make one intentional change. Over time, these small shifts add up to powerful transformation.