Tackling Debt: Strategies for Paying It Down Faster

Tackling Debt: Strategies for Paying It Down Faster

Debt can feel like a heavy burden that weighs you down, affecting not just your finances but your mental and emotional well-being as well. Whether it’s student loans, credit card balances, or a mortgage, the constant pressure of outstanding debt can feel overwhelming. In today’s economic landscape, managing debt effectively has become more important than ever. With rising costs, fluctuating interest rates, and a growing financial insecurity in many households, developing strategies to pay down debt faster is a vital skill for achieving long-term financial freedom.

In this article, we will explore effective strategies for paying down debt faster, offering practical advice, examples, and tools to help you achieve a debt-free future.

Why Tackling Debt Matters

The first step to taking control of your financial future is acknowledging the importance of managing your debt. Debt isn’t inherently bad, but unchecked, it can hinder your ability to save, invest, and plan for the future. High-interest debts—such as credit cards—can escalate quickly, creating a cycle of debt that’s hard to escape. The key is to develop a strategy that allows you to reduce or eliminate your debt as quickly as possible, giving you more freedom and financial security in the long run.

Debt impacts more than just your bank account. It can affect your ability to buy a home, start a business, or achieve other financial goals. It also weighs on your emotional and mental health, leading to stress and anxiety. Tackling debt head-on can provide relief, peace of mind, and ultimately, freedom.

Understanding Your Debt

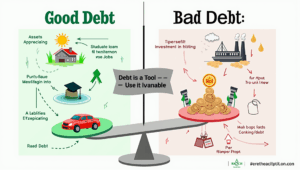

Before you can effectively tackle your debt, it’s important to understand the different types of debt and their associated risks. Generally, debt falls into two broad categories:

- Good Debt: This includes loans for education or a mortgage. These types of debt often have lower interest rates and can contribute to long-term wealth-building if managed properly.

- Bad Debt: This is high-interest debt, such as credit card debt, payday loans, and consumer loans. It can accumulate quickly and often doesn’t provide long-term value.

Key Considerations When Tackling Debt:

- Interest Rates: High-interest rates can cause your debt to grow faster, especially with revolving credit such as credit cards. Understanding how interest affects your debt load is crucial for prioritizing repayments.

- Minimum Payments: Many debts have minimum monthly payments that only cover interest or a small portion of the principal. Paying only the minimum will result in your debt taking much longer to pay off, especially with high-interest loans.

- Debt-to-Income Ratio: This is a critical measure of your ability to manage debt. The higher the ratio, the more of your income is being used to service debt, which can limit your financial flexibility.

Once you’ve assessed your current debts, you can begin applying effective strategies to reduce and pay them off more quickly.

Strategies for Paying Off Debt Faster

1. The Debt Snowball Method

The debt snowball method is one of the most popular and effective strategies for paying down debt. This approach focuses on paying off your smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, you move to the next smallest, and so on.

Example: If you have three debts—$500 on a credit card, $2,000 on a personal loan, and $10,000 on a car loan—you would focus on paying off the $500 first. Once that’s paid off, you shift to the $2,000 loan and then the $10,000 debt. This method works well for those who need motivation and quick wins to build momentum.

Why it works: The psychological benefit of seeing debts disappear quickly can be incredibly motivating. It gives you a sense of accomplishment and encourages you to stay committed to the process.

2. The Debt Avalanche Method

The debt avalanche method is more focused on minimizing the amount of interest paid over time. In this strategy, you prioritize paying off the highest-interest debt first, while continuing to make minimum payments on the others. Once the highest-interest debt is cleared, you move to the next highest, and so on.

Example: If you have credit card debt at 18%, a personal loan at 6%, and a car loan at 3%, you would focus on paying off the credit card debt first. The key to this method is focusing on interest, which will save you more money in the long run.

Why it works: The debt avalanche method saves you the most money over time because you’re reducing the balance that’s accruing interest the fastest. It may take longer to see your first debt paid off, but it’s a more financially efficient approach.

3. Consolidation or Refinancing

Debt consolidation or refinancing involves combining multiple debts into one loan with a potentially lower interest rate. This can make your debt easier to manage, as you only need to keep track of one payment.

Example: If you have multiple credit card balances, you might be able to consolidate them into a single loan with a lower interest rate. Similarly, refinancing a car loan or mortgage can reduce your monthly payments and the overall interest you pay.

Why it works: By consolidating debt, you can simplify your finances and potentially lower your interest rate, making it easier to pay off your debt faster. However, you need to be careful about the terms and fees involved with consolidation or refinancing.

4. Increase Your Income

While reducing expenses is crucial, increasing your income can also significantly speed up your debt repayment process. Whether it’s taking on a part-time job, freelancing, or selling unused items, putting extra money toward your debt can make a noticeable difference.

Example: Sarah, a graphic designer, decided to take on weekend freelance projects. The additional $500 per month helped her pay off her credit card debt 12 months sooner than she had planned.

Why it works: Boosting your income accelerates the rate at which you pay down debt. The extra funds can be allocated directly to your debts, helping you pay them off faster without affecting your day-to-day living expenses.

5. Automate Your Payments

Automating your debt payments ensures that you’re consistently paying off your debts and helps prevent late fees. Setting up automatic payments for the minimum payment or more can keep you on track, especially if you’re trying to stick to a budget or pay off debt on a strict timeline.

Example: John set up automatic payments for his student loan and credit card bills. By doing so, he ensured that his payments were always on time, avoiding penalties and boosting his credit score in the process.

Why it works: Automation removes the need for constant reminders and ensures that you stay disciplined with your payments. It can also free up your time to focus on other important aspects of your finances.

Real-Life Example: Maria’s Journey to Debt Freedom

Maria had a total of $15,000 in debt spread across several credit cards and a car loan. Initially, she was overwhelmed by the amount of debt she had accumulated over the years. After reviewing her finances and setting clear goals, Maria decided to implement the debt avalanche method.

She focused on her credit card with the highest interest rate and was able to pay it off in just six months. By using the money that had previously gone toward her highest-interest debt, she then tackled the next largest debt, a personal loan, and reduced her debt by $7,000 in one year. With her payments streamlined and her priorities clear, Maria was debt-free in less than two years.

Key Takeaways and Next Steps

- Understand Your Debt: Before you can pay down debt effectively, it’s important to understand the types of debt you have, interest rates, and your debt-to-income ratio.

- Choose a Strategy: The debt snowball and debt avalanche methods are two popular strategies for tackling debt. Choose the one that suits your financial situation and personality.

- Boost Your Income: Consider taking on a side hustle or freelance work to accelerate your debt repayment.

- Automate Payments: Set up automatic payments to stay consistent with your debt paydown efforts.

- Track Your Progress: Regularly assess how much debt you’ve paid off and make adjustments to your plan if necessary.

By applying these strategies, you can begin to pay down your debt faster and move toward a more secure and financially free future. It’s important to stay disciplined and focused, but the rewards are worth it. The journey to financial freedom starts with small steps, but with the right strategies, you’ll make meaningful progress.

So, take action today. Review your debts, choose a strategy, and begin your journey toward a debt-free life.