Good Debt vs. Bad Debt: Knowing the Difference

Good Debt vs. Bad Debt: Knowing the Difference

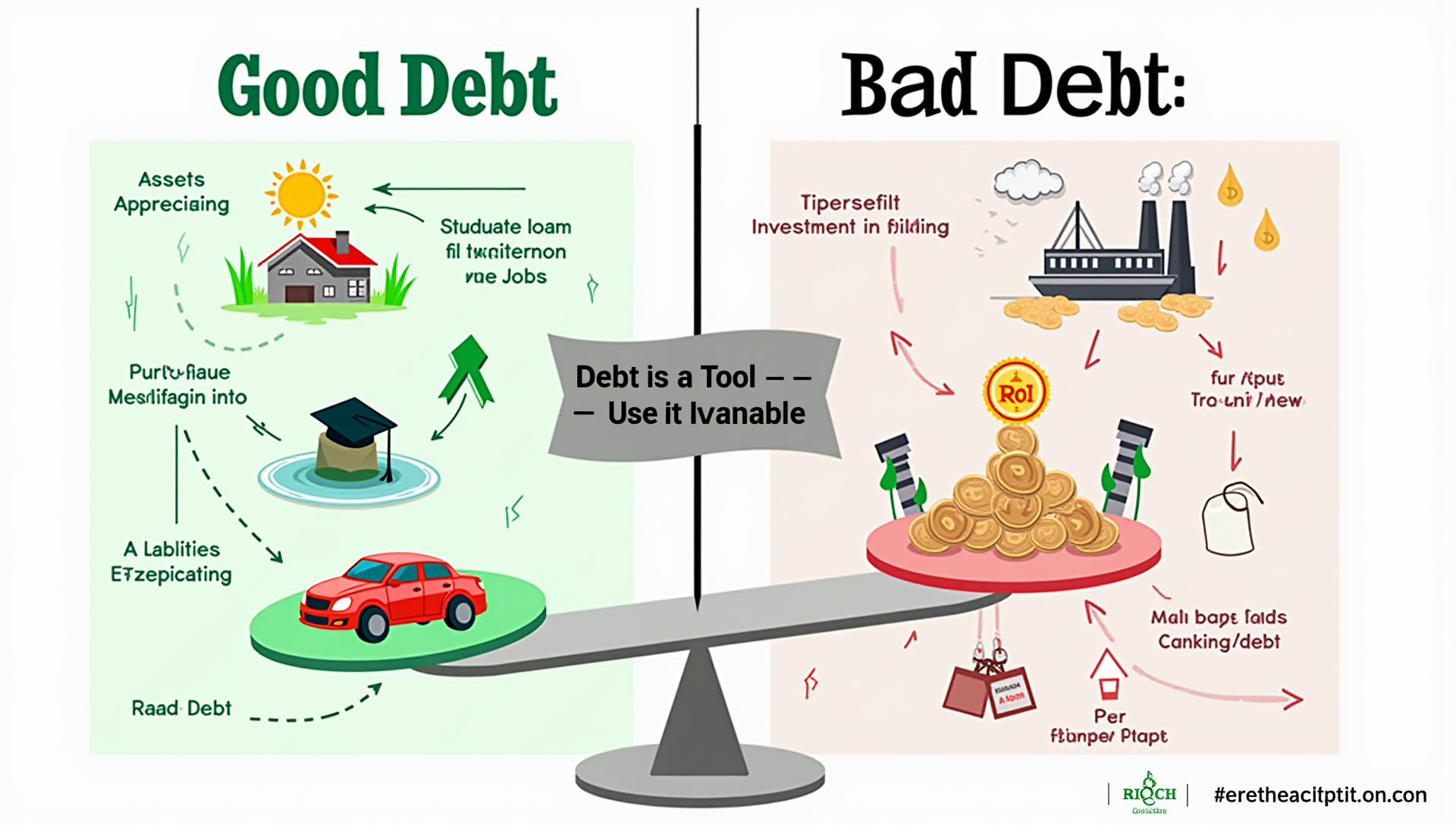

In today’s increasingly credit-reliant world, debt is often seen as a four-letter word—something to be feared or avoided. However, not all debt is created equal. Understanding the difference between good debt and bad debt is essential to making informed financial decisions and building a solid financial future.

This article explores the concepts of good and bad debt, why they matter, and how to use debt strategically without falling into financial traps.

What Is Debt?

At its core, debt is money you borrow with the promise to repay it, often with interest. It can come in many forms—credit cards, student loans, mortgages, personal loans, auto loans, and more. While debt carries inherent risk, it also holds potential benefits when used wisely.

Defining Good Debt

Good debt is borrowing that helps you generate income, build wealth, or improve your financial situation in the long term. It’s considered an investment in your future.

Examples of Good Debt:

- Student Loans: Education can lead to higher earning potential over your lifetime. Though student debt can be burdensome, it’s often seen as an investment in your skills and career.

- Mortgages: Buying a home builds equity over time. With responsible borrowing and a favorable housing market, homeownership can be a wealth-building tool.

- Business Loans: Borrowing to start or grow a business can generate significant income if the business succeeds.

Key Characteristics of Good Debt:

- Offers long-term value

- Helps build assets or income

- Comes with reasonable interest rates and terms

Real-World Example: Sarah took out a $30,000 student loan to earn a nursing degree. After graduation, she secured a job with a $70,000 salary. Her education led directly to a higher income and stable employment—making her student loan good debt.

Defining Bad Debt

Bad debt typically involves borrowing to purchase depreciating assets or fund short-term wants rather than needs. It often comes with high interest rates and little to no long-term financial benefit.

Examples of Bad Debt:

- Credit Card Debt: Using credit cards for non-essential purchases and not paying the full balance results in high interest charges.

- High-Interest Personal Loans: Taking out loans to fund vacations or luxury items can lead to a cycle of debt without any return.

- Auto Loans (in some cases): Cars depreciate rapidly. Taking on a large car loan—especially with high interest—can be a financial setback.

Key Characteristics of Bad Debt:

- Funds non-essential spending

- High interest rates and fees

- Offers little or no financial return

Real-World Example: Jake buys a $5,000 designer sound system using a credit card with a 22% interest rate. He only makes minimum payments, causing him to pay far more than the original cost over time—with no financial benefit in return.

Gray Areas: Debt That’s Not Clearly Good or Bad

Some debts straddle the line and can be either good or bad depending on how they’re used.

Example: Auto Loans A modest car loan with a low interest rate for a reliable vehicle needed for work can be considered good debt. However, financing a luxury car you can’t afford could qualify as bad debt.

Example: Home Equity Loans Using a home equity loan to renovate your house and increase its value can be smart. But using it for discretionary spending is risky and potentially harmful.

Factors to Consider Before Taking on Debt

When evaluating whether a debt is good or bad for your situation, consider the following:

- Purpose: Are you investing in your future or financing instant gratification?

- Interest Rate: The higher the rate, the more expensive the debt.

- Return on Investment: Will the debt help you increase your income, build equity, or gain valuable assets?

- Repayment Terms: Can you realistically afford the monthly payments?

- Opportunity Cost: What are you giving up to service the debt?

Tips for Managing Debt Wisely

Even good debt can become a burden if not managed responsibly. Here’s how to stay in control:

- Create a Budget: Track income and expenses to avoid overspending.

- Limit High-Interest Borrowing: Use credit cards sparingly and pay balances in full.

- Make Extra Payments: Pay more than the minimum to reduce principal faster.

- Build an Emergency Fund: Prevent needing debt for unexpected expenses.

- Use Debt Strategically: Only borrow when it serves a specific, beneficial purpose.

Common Debt Management Mistakes to Avoid

- Ignoring Your Debt: Hoping it will go away only makes things worse.

- Taking on More Than You Can Handle: Be honest about what you can repay.

- Chasing Rewards or Points: Don’t let loyalty programs justify unnecessary spending.

- Not Shopping Around for Better Terms: Compare interest rates and fees before borrowing.

Final Thoughts

Debt doesn’t have to be your enemy. When used wisely, it can be a tool to build your future, invest in yourself, and grow your wealth. The key is understanding the difference between good debt and bad debt and making informed decisions that align with your long-term financial goals.

Before you borrow, ask yourself: Is this helping me or hurting me in the long run?

By recognizing the role of debt in your financial journey, managing it wisely, and avoiding common pitfalls, you can use debt as a stepping stone rather than a stumbling block.

Take charge of your financial health today—review your current debts, identify which are beneficial or harmful, and make a plan to improve your financial future.