Good Debt vs. Bad Debt: Knowing the Difference In today’s increasingly credit-reliant world, debt is often seen as a four-letter word—something to be feared or avoided. However, not all debt is created equal. Understanding the difference between good debt and bad debt is essential to making informed financial decisions and building a solid financial future. …

Building Credit from Scratch: A Step-by-Step Guide In today’s financial world, a strong credit score is one of the most important tools for achieving financial stability and success. Whether you’re looking to secure a loan, get a credit card, or rent an apartment, your credit score plays a critical role in many aspects of your …

Balance Transfers and Consolidation: Are They Right for You? In a world where debt is increasingly common, managing multiple credit cards, loans, and interest rates can be overwhelming. For those struggling to keep up with payments or simply looking for more efficient ways to pay off debt, balance transfers and debt consolidation can offer a …

Tackling Debt: Strategies for Paying It Down Faster Debt can feel like a heavy burden that weighs you down, affecting not just your finances but your mental and emotional well-being as well. Whether it’s student loans, credit card balances, or a mortgage, the constant pressure of outstanding debt can feel overwhelming. In today’s economic landscape, …

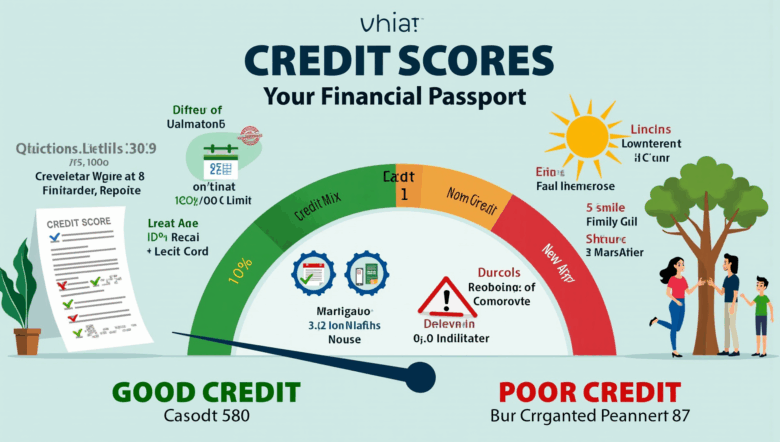

Understanding Credit Scores: What They Are and Why They Matter In today’s fast-paced and credit-driven world, your credit score plays a crucial role in determining your financial opportunities. Whether you’re applying for a credit card, buying a car, renting an apartment, or even applying for a job, your credit score can make a significant impact. …

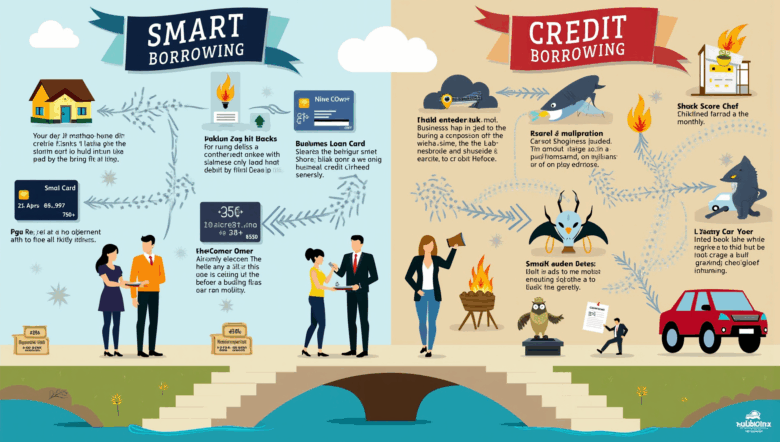

Smart Borrowing: When and How to Use Credit Wisely In today’s modern economy, access to credit is easier than ever—but so is falling into debt. Credit cards, loans, and financing options can be powerful tools when used strategically, yet they can also become financial pitfalls if mismanaged. That’s why understanding the principles of smart borrowing …

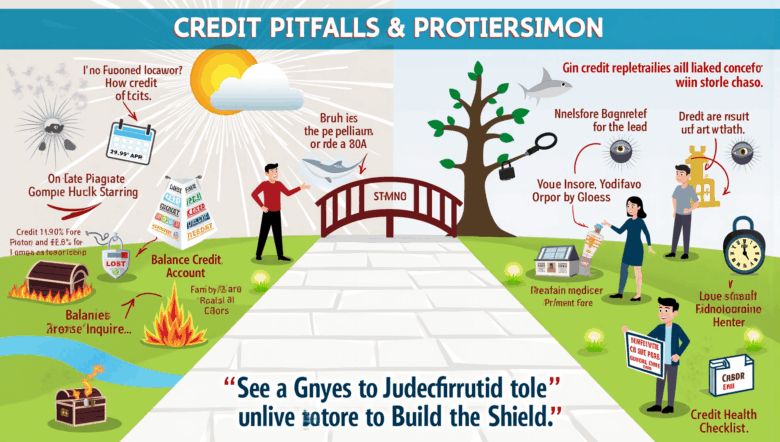

Avoiding Common Credit Pitfalls and Traps In an era where credit cards, buy-now-pay-later plans, and easy online financing options abound, managing credit responsibly has never been more important. While access to credit can help you build a solid financial foundation, missteps can lead to high interest charges, mounting debt, and long-term damage to your credit …

Tracking Progress: Tools and Tips to Stay on Goal In the pursuit of financial goals—whether it’s paying off debt, saving for a dream vacation, building an emergency fund, or investing for retirement—setting goals is only the beginning. The real magic happens in the tracking. Without consistently monitoring progress, it’s easy to drift off course, lose …

Cutting Expenses Without Cutting Joy: Creative Saving Hacks In today’s fast-paced world, where inflation and economic uncertainty seem ever-present, finding ways to save money is more relevant than ever. However, saving doesn’t have to mean sacrificing the things you love. By adopting a mindful approach and embracing creativity, you can reduce expenses without feeling deprived. …

Automating Savings: How to Pay Yourself First In today’s world of instant gratification and digital spending, saving money can feel like an uphill battle. With bills to pay, responsibilities to manage, and tempting purchases always a click away, setting aside money for the future often falls to the bottom of the priority list. But what …