Emergency Funds: Why They Matter and How to Build One

Emergency Funds: Why They Matter and How to Build One

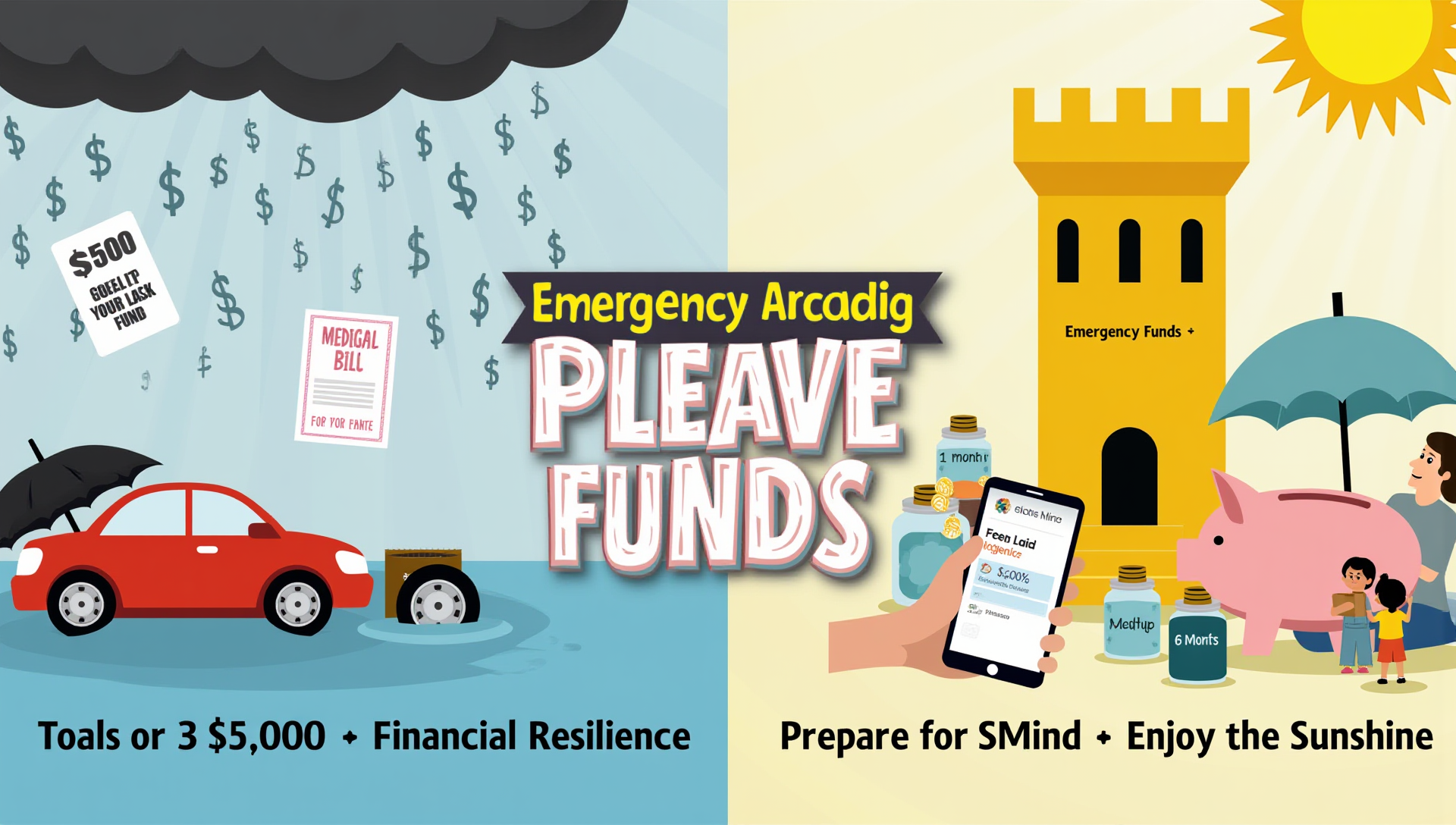

In a world of financial uncertainty—job losses, medical emergencies, unexpected home repairs—an emergency fund serves as a financial safety net. It’s the buffer that prevents life’s surprises from turning into long-term setbacks. Especially in today’s volatile economic climate, having an emergency fund is more important than ever.

This article explores why emergency funds matter, how much you should save, where to keep the money, and step-by-step strategies to build one from scratch. With real-life scenarios, tips, and practical advice, you’ll be equipped to take control of your financial future with confidence.

What Is an Emergency Fund?

An emergency fund is a stash of money set aside specifically to cover unexpected expenses or financial emergencies. Think of it as insurance—but instead of paying premiums, you’re paying yourself for future peace of mind.

Common uses for an emergency fund include:

- Medical emergencies

- Car repairs

- Sudden job loss

- Unexpected travel (e.g., family emergencies)

- Major home repairs (e.g., broken furnace, leaking roof)

This fund is not intended for planned expenses like vacations, down payments, or new gadgets. It’s there to help you survive and maintain your lifestyle during unforeseen events.

Why Emergency Funds Matter

1. Reduces Stress and Anxiety

Financial uncertainty is a major source of stress. Knowing you have a safety net can bring peace of mind and prevent panic in crisis situations.

2. Avoids High-Interest Debt

Without an emergency fund, many people turn to credit cards or payday loans to cover unexpected costs—leading to debt cycles that can be hard to break.

3. Prevents Derailing Long-Term Goals

Emergency expenses can derail your financial progress. Dipping into your retirement fund or long-term investments can result in penalties and lost growth potential.

4. Provides Flexibility and Security

An emergency fund gives you the freedom to make smart, rather than rushed, decisions in times of crisis. Whether it’s quitting a toxic job or taking unpaid leave to care for a loved one, having savings offers options.

How Much Should You Save?

The ideal size of an emergency fund depends on your personal circumstances. However, general guidelines recommend:

- Basic cushion: $500–$1,000 to cover minor emergencies (ideal starting point for beginners)

- Standard safety net: 3 to 6 months’ worth of essential living expenses

Factors that influence how much you should save:

- Job stability (freelancers may need more)

- Number of dependents

- Health considerations

- Existing debt load

- Availability of other assets or support systems

Where to Keep Your Emergency Fund

An emergency fund should be:

- Easily accessible but not too easy to dip into for non-emergencies

- Safe from market risk

- Separate from your daily spending accounts

Recommended options:

- High-yield savings accounts

- Money market accounts

- Certificates of deposit (CDs) with no early withdrawal penalties

Avoid tying up emergency savings in stocks or long-term investments, where market fluctuations could reduce your balance when you need it most.

How to Build an Emergency Fund: Step-by-Step

Step 1: Set a Realistic Initial Goal

Start small—aim for $500 to $1,000. Reaching this goal quickly builds momentum and gives you coverage for common emergencies like car repairs or medical co-pays.

Step 2: Create a Budget

Track your income and expenses to see where you can free up money. Allocate a portion of your monthly income specifically for your emergency fund.

Tip: Use budgeting apps like Mint or YNAB to identify areas where you can cut back (e.g., subscriptions, dining out).

Step 3: Automate Savings

Set up automatic transfers from your checking to your emergency fund. Treat it like a non-negotiable bill to ensure consistency.

Step 4: Redirect Windfalls

Tax refunds, bonuses, rebates, or gifts are great opportunities to boost your emergency fund quickly.

Step 5: Cut Costs Strategically

Look for areas to trim temporarily:

- Cancel unused subscriptions

- Cook at home more often

- Shop with a list to avoid impulse buys

Put these savings directly into your emergency fund.

Step 6: Keep It Separate

Avoid temptation by using a separate savings account that’s not linked to your debit card. Consider using a financial institution you don’t use for everyday spending.

Step 7: Celebrate Milestones

Recognize and celebrate progress—every $100 saved is a step toward security. This builds motivation and reinforces the habit.

Real-World Scenarios

Scenario 1: The Unexpected Layoff Mark, a graphic designer, was laid off without notice. Fortunately, he had five months’ worth of expenses saved. This gave him breathing room to find a new job without rushing into a poor fit or incurring debt.

Scenario 2: Medical Emergency Lisa’s child broke an arm, resulting in a $2,000 ER bill. Her emergency fund covered the cost, avoiding credit card debt and high-interest payments.

Scenario 3: Car Trouble Jared’s car broke down two weeks before payday. Thanks to his $800 emergency cushion, he was able to get it repaired without financial strain.

Common Questions About Emergency Funds

Can I invest my emergency fund to grow it faster? It’s not recommended. Emergency funds need to be safe and liquid, not exposed to market risk.

What if I already have debt? Should I save or pay off debt first? Start by saving a small emergency fund (e.g., $1,000) while making minimum debt payments. Once that’s in place, aggressively tackle high-interest debt.

What qualifies as an emergency? Ask yourself:

- Is it unexpected?

- Is it necessary?

- Is it urgent? If the answer is “yes” to all three, it likely qualifies.

Final Thoughts

An emergency fund is not a luxury—it’s a financial essential. It cushions life’s surprises, prevents debt accumulation, and supports long-term financial health. Whether you’re a student, a parent, a freelancer, or nearing retirement, having a cash reserve is one of the smartest financial moves you can make.

Start small, stay consistent, and build over time. The peace of mind that comes from having an emergency fund is priceless—and the best time to start building yours is now.

So take the first step today: open a savings account, set your goal, and commit to saving a little each month. Your future self will thank you.