Mastering the Basics: How to Create a Budget That Works

Mastering the Basics: How to Create a Budget That Works

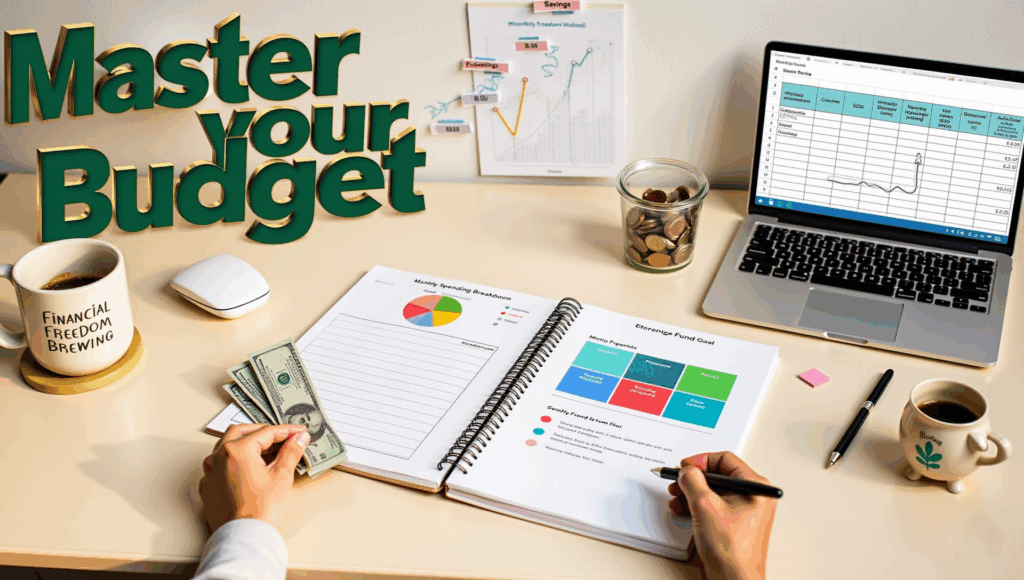

In today’s fast-paced world, financial stability often feels like an elusive goal. Rising costs, unexpected expenses, and the pressure to keep up with modern lifestyles can make managing money a daunting task. This is where budgeting steps in as a powerful tool to bring order to financial chaos. Crafting a budget that works is not just about cutting back on expenses; it’s about gaining control, setting priorities, and achieving financial peace of mind.

Why Budgeting Matters

Budgeting is more relevant now than ever. With inflation, economic uncertainties, and increasing consumer debt, having a clear plan for where your money goes is essential. A well-structured budget helps you:

- Understand your income and expenses

- Avoid overspending and accumulating debt

- Save for short-term needs and long-term goals

- Reduce financial stress and build confidence in money management

Understanding the Core Concepts of Budgeting

Before diving into the practical steps, it’s important to grasp the fundamental components of a budget:

- Income: This includes all sources of money you receive, such as salaries, freelance income, side hustles, investments, and government benefits.

- Fixed Expenses: These are recurring costs that don’t change much month to month, like rent or mortgage, car payments, insurance, and subscriptions.

- Variable Expenses: These fluctuate monthly and include groceries, dining out, entertainment, and utilities.

- Discretionary Spending: Non-essential expenses like shopping, travel, and hobbies fall into this category.

- Savings and Debt Repayment: Any money set aside for savings, investments, or paying down debt should be considered part of your budget.

Steps to Create a Budget That Works

Steps to Create a Budget That Works

1. Track Your Spending

Start by monitoring your spending for a month. Use a spreadsheet, budgeting app, or even a notebook. Categorize every expense and calculate your total income. This snapshot of your financial life is your starting point.

Example: Sarah, a graphic designer, discovered she was spending $200 a month on coffee and lunches. Realizing this, she started packing lunch and making coffee at home, saving $150 monthly.

2. Set Clear Financial Goals

What are you budgeting for? Define short-term goals (e.g., paying off credit cards, saving for a vacation) and long-term goals (e.g., buying a home, retirement planning). Having a purpose makes budgeting more motivating.

Tip: Use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) to stay focused.

3. Choose a Budgeting Method

Different budgeting techniques work for different people. Popular methods include:

- Zero-Based Budgeting: Every dollar is assigned a job, with income minus expenses equaling zero.

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings/debt repayment.

- Envelope System: Use cash in envelopes for categories like groceries or entertainment to prevent overspending.

Real-World Scenario:

John and Lisa, a couple with irregular freelance incomes, use zero-based budgeting each month based on projected earnings. This helps them stay adaptable while still meeting their goals.

4. Build an Emergency Fund

An essential aspect of budgeting is preparing for the unexpected. Aim to save 3-6 months of expenses in an easily accessible account.

Practical Advice: Start small. Even saving $500 can provide a cushion for minor emergencies like car repairs or medical co-pays.

5. Review and Adjust Regularly

A budget isn’t a one-time project. Life changes—income increases, expenses fluctuate, priorities shift. Review your budget monthly and make necessary adjustments.

Example: Emma, a teacher, increased her savings rate after receiving a raise, allowing her to meet her goal of buying a new car a year ahead of schedule.

6. Automate Where Possible

Automate bill payments, savings contributions, and debt repayments. This reduces the risk of missed payments and helps reinforce good financial habits.

Overcoming Common Budgeting Challenges

Impulse Spending: Use the 24-hour rule—wait a day before making non-essential purchases. This helps curb emotional buying.

Irregular Income: Budget based on your lowest expected income month, and create a buffer during higher-earning months.

Lack of Motivation: Visualize your goals with vision boards or savings trackers. Celebrate small wins to stay encouraged.

Budget Fatigue: Keep things flexible. Allow some “fun money” to avoid feeling restricted.

Tools and Resources

There are numerous tools to simplify the budgeting process:

- Apps: Mint, YNAB (You Need a Budget), EveryDollar

- Spreadsheets: Google Sheets, Excel templates

- Banking Tools: Many banks offer budgeting features in their apps

Final Thoughts: Building a Financially Empowered Life

Budgeting is not about perfection. It’s about progress, awareness, and control. A good budget reflects your values and helps you make conscious decisions about money. By mastering the basics, you lay the groundwork for financial freedom and resilience.

Whether you’re just starting out or looking to refine your financial plan, remember that budgeting is a skill—one that improves with practice. Begin today with small steps, track your progress, and don’t be afraid to tweak your approach as you go.