Emergency Funds: Why They Matter and How to Build One In a world of financial uncertainty—job losses, medical emergencies, unexpected home repairs—an emergency fund serves as a financial safety net. It’s the buffer that prevents life’s surprises from turning into long-term setbacks. Especially in today’s volatile economic climate, having an emergency fund is more important …

Budgeting Basics: Building a Plan to Support Your Savings In today’s fast-paced and often unpredictable financial environment, budgeting is no longer just a good idea—it’s a necessity. Whether you’re saving for an emergency fund, a dream vacation, or long-term goals like homeownership or retirement, having a solid budgeting foundation can help you get there faster …

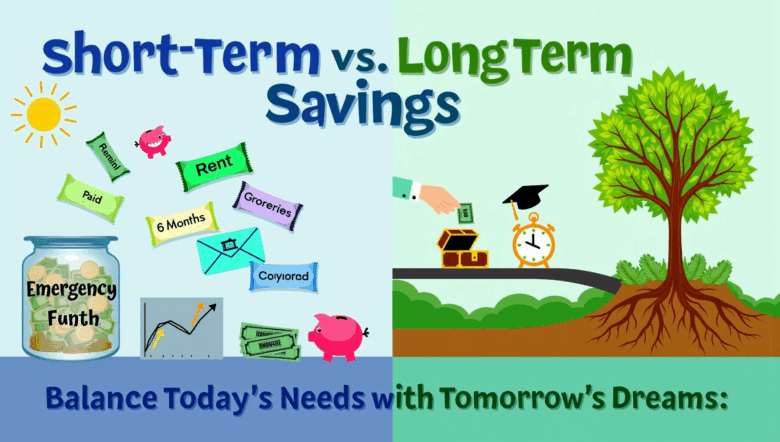

Short-Term vs. Long-Term Savings: What You Need to Know In today’s rapidly changing economic climate, saving money is more than just a good habit—it’s a necessity. Whether you’re saving for a rainy day or planning for retirement, understanding the distinction between short-term and long-term savings is crucial. Each serves a different purpose, has its own …

Setting SMART Financial Goals for Long-Term Success In today’s fast-paced, financially complex world, setting clear financial goals is more important than ever. Whether you’re trying to pay off debt, build an emergency fund, save for a home, or plan for retirement, having a structured approach can be the difference between wishful thinking and real progress. …

Mindful Money Management: Aligning Spending with Your Values In a world driven by consumerism and instant gratification, mindful money management offers a refreshing and empowering alternative. It’s not just about budgeting or tracking expenses—it’s about consciously aligning your spending habits with your core values, priorities, and long-term goals. In today’s fast-paced financial environment, where lifestyle …

Adjusting Your Budget for Life Changes and Unexpected Costs In the dynamic landscape of modern life, change is the only constant. Whether it’s a career shift, a medical emergency, a new addition to the family, or even a global event like a pandemic, life changes can have a significant impact on your finances. While budgeting …

Budgeting Apps & Tools: Choosing the Right One for You In an era where digital convenience meets financial literacy, budgeting apps and tools have emerged as essential companions for managing personal finances. Whether you’re striving to pay off debt, save for a big goal, or simply gain control over your spending, the right budgeting app …

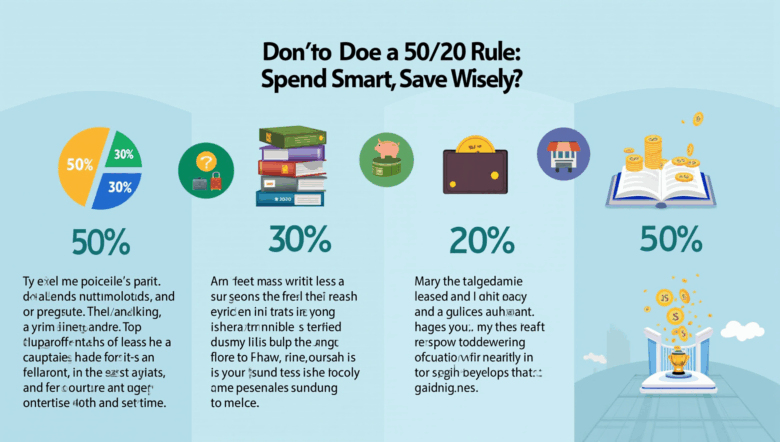

The 50/30/20 Rule: A Simple Formula for Smarter Spending In an era where financial literacy is increasingly important yet often overlooked, managing personal finances has never been more critical. With rising costs of living, fluctuating job markets, and the temptation of lifestyle inflation, many people find themselves struggling to find balance in their financial lives. …

Tracking Spending: Small Habits That Make a Big Difference In a world of one-click purchases, cashless transactions, and subscription services, it’s easier than ever to lose track of where your money is going. While earning more is often seen as the path to financial freedom, what you do with the money you already have plays …

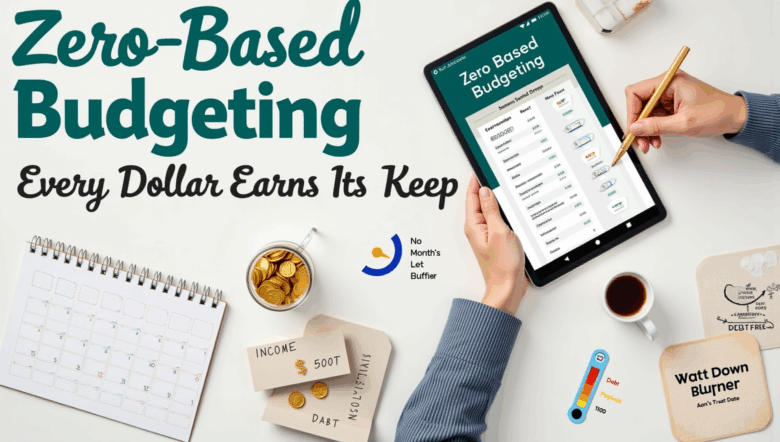

Zero-Based Budgeting: Giving Every Dollar a Purpose In today’s rapidly evolving financial landscape, the need for intentional money management has never been greater. Rising living costs, economic uncertainty, and the desire for financial independence are prompting individuals and families to seek budgeting systems that foster clarity, discipline, and control. Among these, zero-based budgeting (ZBB) stands …