Smart Borrowing: When and How to Use Credit Wisely

Smart Borrowing: When and How to Use Credit Wisely

In today’s modern economy, access to credit is easier than ever—but so is falling into debt. Credit cards, loans, and financing options can be powerful tools when used strategically, yet they can also become financial pitfalls if mismanaged. That’s why understanding the principles of smart borrowing is crucial for maintaining financial health and building a secure future.

This article explores when borrowing makes sense, how to use credit wisely, and practical strategies to stay in control of your debt.

Why Borrowing Can Be a Smart Financial Move

Borrowing isn’t inherently bad. In fact, it can help you:

- Build credit history

- Cover necessary expenses during emergencies

- Invest in long-term assets like education or a home

- Smooth out irregular cash flows

The key lies in making informed decisions based on your financial situation, goals, and ability to repay.

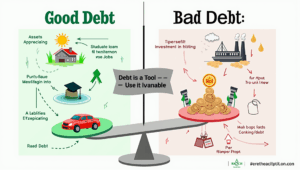

When Does Borrowing Make Sense?

Borrowing should be aligned with long-term benefits and your ability to repay. Consider borrowing when:

- Investing in your future: Taking out student loans to gain education or a mortgage to buy a home can be considered “good debt” when it increases your earning potential or asset value.

- Managing cash flow during emergencies: A personal loan with a low interest rate might be a lifeline during unexpected expenses, especially if you don’t have an emergency fund.

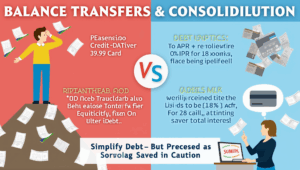

- Consolidating high-interest debt: Replacing multiple debts with one lower-interest loan can save money and simplify repayment.

Avoid borrowing for:

- Everyday expenses like groceries or entertainment

- Luxury items that depreciate quickly

- Keeping up appearances or lifestyle inflation

Types of Credit and Their Best Uses

Understanding the types of credit can help you use each one more effectively:

1. Credit Cards

Best for convenience and short-term borrowing. Benefits include rewards, fraud protection, and flexibility. However, interest rates are typically high, so pay balances in full each month.

2. Personal Loans

These unsecured loans can be used for debt consolidation, home repairs, or major purchases. They often have lower interest rates than credit cards.

3. Auto Loans

Used specifically for purchasing a car. Shop around for the best terms and avoid financing more than you can afford.

4. Mortgages

Long-term loans to buy property. Because this is a major commitment, compare lenders, understand terms, and consider your long-term stability.

5. Student Loans

Meant for educational expenses. Federal student loans typically offer better terms and protections than private ones.

The Golden Rules of Smart Borrowing

1. Only Borrow What You Can Afford to Repay

Never borrow more than you can comfortably pay back. Create a budget and ensure future payments won’t strain your finances.

2. Understand the Total Cost of Borrowing

Look beyond the interest rate. Factor in fees, loan terms, and compounding interest. Use loan calculators to understand the full cost.

3. Maintain a Strong Credit Score

Your credit score affects the interest rates and terms you receive. Always pay on time, keep balances low, and avoid unnecessary credit inquiries.

4. Pay More Than the Minimum

If you’re using a credit card or loan, paying only the minimum extends your repayment period and increases interest costs. Aim to pay more than required when possible.

5. Have a Repayment Plan

Know how and when you’ll repay any money you borrow. Create a plan that fits your income, lifestyle, and goals.

Real-World Scenario: Smart vs. Risky Borrowing

Smart Borrowing: Rachel needed a car for work. Instead of opting for a brand-new model with a hefty monthly payment, she chose a reliable used car and secured a low-interest auto loan. She put down a sizable deposit and chose a loan term she could comfortably manage.

Risky Borrowing: Meanwhile, her friend Jake took out multiple credit cards to fund a lavish vacation and new electronics. Within months, he struggled with minimum payments and watched his credit score decline.

Tips for Staying Debt-Savvy

- Automate your payments to avoid late fees

- Review your credit reports annually for errors

- Limit the number of active credit lines

- Don’t use credit as income—credit is a tool, not a source of money

- Build an emergency fund to reduce reliance on borrowing during tough times

- How Borrowing Affects Your Financial Goals

Used wisely, borrowing can help you achieve important life goals—buying a home, pursuing higher education, or starting a business. But misusing credit can derail your progress.

Align borrowing decisions with your financial plan. For example:

- Don’t take on new debt if you’re saving for a down payment.

- Use credit strategically to boost your score before applying for a mortgage.

Conclusion: Borrow Smart, Live Free

Credit can be a powerful ally or a dangerous adversary. Smart borrowing means using credit intentionally, with a clear understanding of your needs, limitations, and financial goals.

Before you borrow, ask yourself:

- Do I really need this?

- Can I afford the repayments?

- What are the long-term consequences?

By embracing discipline, knowledge, and planning, you can harness the power of credit to enhance—not hinder—your financial future. Borrow smart, stay informed, and use credit as a stepping stone toward your dreams, not a stumbling block.

Your financial freedom depends not just on how much you earn, but how wisely you borrow. Start today by reviewing your current credit habits and making small, smart adjustments toward a more secure tomorrow.