The 50/30/20 Rule: A Simple Formula for Smarter Spending

The 50/30/20 Rule: A Simple Formula for Smarter Spending

In an era where financial literacy is increasingly important yet often overlooked, managing personal finances has never been more critical. With rising costs of living, fluctuating job markets, and the temptation of lifestyle inflation, many people find themselves struggling to find balance in their financial lives. One tried-and-true strategy that offers clarity and simplicity is the 50/30/20 rule of budgeting. This straightforward yet powerful method helps individuals take control of their money by assigning specific percentages of income to three essential categories: needs, wants, and savings.

What is the 50/30/20 Rule?

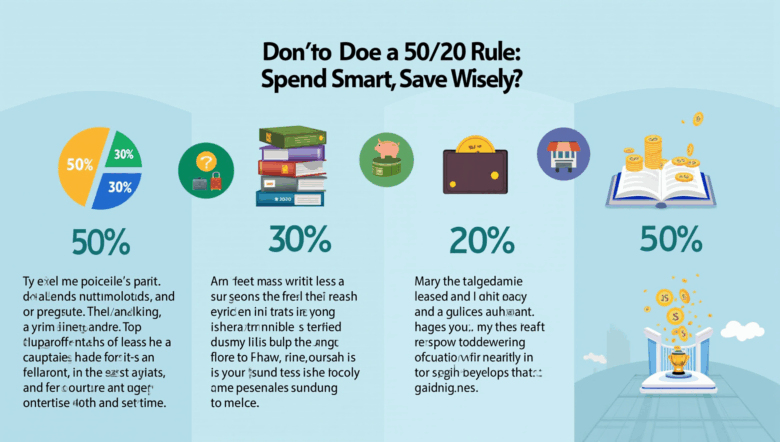

The 50/30/20 rule is a budgeting principle that allocates your after-tax income into three broad categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

This method was popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan”. Its beauty lies in its simplicity, making it accessible for beginners and effective for those looking to fine-tune their finances.

Breaking Down the Categories

1. 50% Needs

Needs are essential expenses you cannot live without. This includes:

- Rent or mortgage payments

- Utilities (electricity, water, heating)

- Groceries

- Health insurance

- Transportation

- Minimum loan payments

Tip: If your needs exceed 50%, consider looking for ways to cut costs—downsizing your home, carpooling, or switching service providers.

2. 30% Wants

Wants are non-essential but enhance your quality of life. These include:

- Dining out

- Subscriptions (Netflix, Spotify)

- Hobbies and entertainment

- Vacations

- Gym memberships

Note: The line between needs and wants can blur. For instance, a basic phone plan is a need; the latest iPhone with an unlimited data plan may fall into the want category.

3. 20% Savings and Debt Repayment

This portion is for securing your financial future. It includes:

- Emergency fund contributions

- Retirement savings (401(k), IRA)

- Investment accounts

- Extra debt payments (beyond the minimum)

Example: If you earn $4,000 per month after taxes:

- $2,000 goes to needs

- $1,200 to wants

- $800 to savings and debt repayment

Why the 50/30/20 Rule Works

- Simplicity: Easy to understand and apply.

- Flexibility: Works with any income level.

- Balance: Encourages both financial responsibility and enjoyment.

- Awareness: Makes spending habits more visible.

How to Implement the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Start with your monthly net income (after federal, state, and payroll taxes). If you’re self-employed, subtract estimated taxes first.

Step 2: Analyze Current Spending

Track your current expenses over one or two months. Categorize them as needs, wants, or savings/debt repayments.

Step 3: Compare with 50/30/20 Percentages

See where your money is currently going. Are you spending 70% on needs and only 5% on savings? If so, it’s time to rebalance.

Step 4: Make Adjustments

- Reduce discretionary spending (e.g., dining out less often)

- Refinance loans or shop for better insurance rates

- Automate savings to prioritize long-term goals

Step 5: Monitor and Adjust

Your budget is a living document. Life changes—like a new job or a medical bill—require periodic reviews and tweaks.

Real-World Examples

Alyssa’s Financial Tune-Up: Alyssa, a graphic designer earning $3,500 monthly, was unknowingly spending 40% on wants and saving just 5%. After adopting the 50/30/20 rule, she cut back on unnecessary online shopping and subscriptions, reallocating funds toward her emergency fund and a Roth IRA. Within six months, she had $2,500 saved.

The Smith Family Budget Reset: The Smiths, a family of four, used the 50/30/20 rule to get out of debt. By renegotiating their internet and phone plans and limiting restaurant visits, they moved from spending 60% on needs to 48%. This allowed them to increase savings and chip away at credit card balances.

Benefits and Considerations

Benefits:

- Promotes consistent savings

- Reduces the stress of money management

- Encourages financial mindfulness

- Helps prioritize goals

Considerations:

- Might not be feasible in high-cost living areas

- Doesn’t account for irregular income (freelancers, gig workers)

- Some expenses may fall into gray areas

Tip: If your needs consume more than 50%, adjust your percentages. For example, aim for 60/20/20 until your situation stabilizes.

Tools and Resources

- Budgeting Apps: YNAB (You Need A Budget), Mint, EveryDollar

- Spreadsheets: Google Sheets budget templates

- Financial Planners: Professional help for complex finances

Final Thoughts: A Simple Path to Financial Freedom

The 50/30/20 rule isn’t just a budgeting method—it’s a mindset. It teaches balance: meet your needs, enjoy your life, and prepare for the future. It empowers people to take control of their money without becoming overwhelmed by financial jargon or complicated systems.

You don’t need to be a financial expert to use it. All it takes is a willingness to look at your spending habits, make thoughtful adjustments, and stick with it. Whether you’re trying to get out of debt, build an emergency fund, or save for a dream vacation, the 50/30/20 rule can serve as your financial compass.